The Priority Series

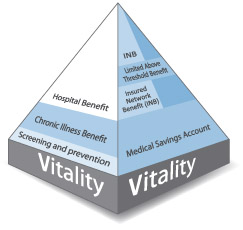

The Priority Plans offer you cost-effective cover in hospital as well as day-to-day benefits

- Unlimited hospital cover in any private hospital

- Essential cover for chronic medicine

- A Medical Savings Account to cover your day-to-day healthcare needs

- Efficient day-to-day limits and a limited Above Threshold Benefit to extend your healthcare cover

- Cover for up to 90 days up to R5 million for each person for medical emergencies when travelling outside South Africa.

Your cover in hospital

Comprehensive hospital cover

We cover you in any private hospital for emergencies and for planned hospital admissions that you have authorised with us. There is no overall hospital limit.

Emergency cover when you need it most

In an emergency, go straight to hospital. If you need medically-equipped transport in a medical emergency, call 0860 999 911. This line is managed by highly qualified emergency personnel who will send the most appropriate air or road emergency evacuation transport. It is important that you, a loved one or the hospital let us know about your admission as soon as possible.

Cover for planned hospital admissions

Please call us at least 48 hours before you go to hospital to confirm your admission.

Limits, clinical guidelines and policies apply to some healthcare services and procedures in hospital.

Going to hospital can be a stressful experience. Discovery’s HospitalXpress makes your admission to hospital convenient and seamless. This service offers you express pre-admissions and online tools to authorise your admission and confirm your cover. HospitalXpress also connects you to select partners, bringing you a range of value-added services at the reduced prices you’re accustomed to as a Discovery member.

Upfront payments for in-hospital procedures

You need to pay an amount upfront to the hospital when you are admitted for one of the following procedures:

| Conservative back and neck treatment, myringotomy (grommets), tonsillectomy, adenoidectomy | R1 750 |

| Colonoscopy, sigmoidoscopy, proctoscopy, gastroscopy, cystoscopy | R2 350 |

| Arthroscopy, functional nasal procedures, hysterectomy (except for pre-operatively diagnosed cancer), laparoscopy, hysteroscopy, endometrial ablation | R4 250 |

| Nissen fundoplication (reflux surgery), spinal (back and neck) surgery, joint replacements | R8 600 |

If the procedure can be done out of hospital, for example in the doctor’s rooms, you won’t have to pay an amount upfront to the hospital. Please call us beforehand to confirm your benefits.

Your cover for healthcare professionals

Full cover for specialists who we have an agreement with

You can benefit by using healthcare professionals who we have an agreement with because we will cover their approved procedures in full. If you are a Classic member, you benefit from access to the broadest range of specialists who we pay in full, which represents over 88% of our members’ specialist interactions. These healthcare professionals, appropriate to your plan, are also the designated providers for Prescribed Minimum Benefits.

You may have a co-payment if you use other specialists

If you are treated by a specialist who we do not have an agreement with, we cover you up to 200% of the Discovery Health Rate on the Classic Plan and up to 100% of the Discovery Health Rate on the Essential Plan. You may have a co-payment if your specialist charges above these rates.

Other healthcare professionals

We cover GPs and other healthcare services up to 200% of the Discovery Health Rate on the Classic Plan and up to 100% of the Discovery Health Rate on Essential Plan.

We cover radiology and pathology up to 100% of the Discovery Health Rate on all plans.

Your cover for investigations

MRI and CT scans

If your MRI or CT scan is done as part of an approved hospital admission, we cover your scan up to 100% of the Discovery Health Rate from your Hospital Benefit.

If you are admitted for conservative back or neck treatment, you have to pay the first R1 750 of the hospital account, and we’ll pay the first R2 300 of the scan code from your day-to-day benefits. We pay the balance of the scan code from your Hospital Benefit, up to 100% of the Discovery Health Rate. Specific rules and limits apply to conservative back and neck scans.

Your cover for dental treatment in hospital

You need to pay a portion of your hospital or day-clinic account upfront for dental admissions. This amount varies, depending on your age and the place of treatment.

| Hospital | Day clinic | |

| Members younger than 13 years | R1 300 | R650 |

| Members 13 years and older | R3 300 | R2 200 |

We pay the balance of the hospital account from the Hospital Benefit, up to 100% of the Discovery Health Rate.

We pay the related accounts, which include the dental surgeon‘s account, from the Hospital Benefit up to 100% of the Discovery Health Rate.

No overall dental limit

There is no overall limit for dental treatment. However, all dental appliances, their placement, and orthodontic treatment (including the related accounts for orthognathic surgery) are paid up to 100% of the Discovery Health Rate from your day-to-day benefits, up to an annual limit of R10 850 a person. If you join the medical scheme after January, you won’t get the full limit because it is calculated by counting the remaining months in the year. The overall Above Threshold Benefit limit applies to this benefit.

Severe dental and oral surgery

The Severe Dental and Oral Surgery Benefit covers a defined list of procedures with no upfront payment and no overall limits. This benefit is subject to authorisation and the Scheme’s specific clinical rules.

Unlimited healthcare services

Most of your in-hospital healthcare services have no overall limit. These are:

- GPs

- Specialists

- Allied healthcare professionals, like physiotherapists

- Pathology

- Radiology

- Basic dental check-ups

- HIV cover

Limited healthcare services

Only the following healthcare services have an annual limit:

| Dental appliances and orthodontic treatment* (including orthognathic surgery) | R10 850 for each person from your day-to-day benefits |

| Cochlear implants, auditory brain implants and processors | R140 000 for each person for each benefit |

| Internal nerve stimulators | R106 000 for each person |

| Hip, knee and shoulder joint prostheses | There is no overall limit if you get your prosthesis from our preferred suppliers. If you choose not to, a limit of R33 000 will apply to each prosthesis. |

| Prosthetic devices used in spinal surgery | R21 000 for the first level, R42 000 for two or more levels, limited to one procedure for each person |

| Mental health benefit | 21 days for each person |

| Alcohol and drug rehabilitation | 21 days for each person |

| Terminal care benefit | R25 250 for each person |

| Chronic dialysis | We cover these expenses in full if we have approved your treatment plan and you use a provider in our network. If you choose not to, you have to make a co-payment. |

DiscoveryCare looks after you in times of need

Your cover for chronic conditions

You have cover for a list of chronic conditions. You have full cover for approved medicine on Discovery Health’s medicine list or up to a set amount for medicine not on our list.

We pay medicine up to the Discovery Health Medicine Rate. We need to approve your chronic condition before it is covered from the Chronic Illness Benefit.

When you use MedXpress, Discovery’s convenient medicine delivery service, you pay no delivery or administration fees. Discovery’s qualified service agents can also advise you on the most cost-effective alternatives and you will always be charged at the Discovery Health Medicine Rate or less – minimizing co-payments. Call us on 0860 99 88 77 to make use of this free service.

Your cover for cancer treatment

Our Oncology Programme covers the first R200 000 of approved cancer treatment over a 12-month cycle. Cover is unlimited once cancer treatment costs go over this amount, but you will need to pay 20% of the cost of all further treatment. We cover chemotherapy and oncology-related medicines up to the Discovery Health Medicine Rate. We pay consultations, radiotherapy, radiology, pathology, scopes and scans up to 100% of the Discovery Health Rate. You might have to make a co-payment if your healthcare professional charges more than the Discovery Health Rate.Cancer treatment that is a Prescribed Minimum Benefit is always covered in full. Please call us to register on the Oncology Programme.

Your cover for day-to-day medical expenses

We pay for day-to-day medical expenses like GP visits, radiology and pathology from your Medical Savings Account, as long as you have money available.

If you run out of money in your Medical Savings Account before your claims add up to the Annual Threshold, you will have to pay your day-to-day medical expenses yourself.

Once your claims add up to the Annual Threshold, we pay the rest of your claims from the Above Threshold Benefit, at the Discovery Health Rate. Your Above Threshold Benefit has an overall limit.

The Insured Network Benefit ensures you have no gaps in cover for GPs and pathology in our network

We extend your day-to-day cover through the Insured Network Benefit. When you have spent your annual Medical Savings Account deposit or reached your Above Threshold Benefit limit:

- We cover the full cost of your consultation fees if you go to a GP in our network. We also cover pathology at our network providers if your GP or specialist requests the tests by filling in the Discovery Health pathology form.

How we make your Medical Savings Account last longer

- We pay these day-to-day expenses without using your Medical Savings Account:The Screening and Prevention Benefit covers certain tests at a Discovery Wellness Network provider, like blood glucose, blood pressure, cholesterol and body mass index. We also cover a mammogram, Pap smear, PSA (a prostate screening test) and HIV screening tests. Members 65 years or older and members registered for certain chronic conditions are also covered for a seasonal flu vaccine.

- We cover out-of-hospital claims for recovery after certain traumatic events from the Trauma Recovery Extender Benefit. The cover applies for the rest of the year in which the trauma took place, and to the year after your trauma.

- We pay for scopes (gastroscopy, colonoscopy, sigmoidoscopy and proctoscopy) done in your doctor’s rooms from your Hospital Benefit. We pay up to 200% of the Discovery Health Rate if you are on a Classic Plan and up to 100% of the Discovery Health Rate if you are on an Essential Plan. Please call us before you have a scope done in your doctor’s rooms to confirm your benefits.

The Above Threshold Benefit offers extra day-to-day cover

The Priority Series has an Above Threshold Benefit that gives you extra day-to-day cover after your Medical Savings Account runs out and when your day-to-day claims add up to a set amount called the Annual Threshold. The Above Threshold Benefit has an overall limit.

- When you claim, we add up the following amounts for you to get to the Annual Threshold: For Premier Rate specialists, we add up the Premier Rate. For specialists who we don’t have an agreement with, we add up 100% of the Discovery Health Rate.

- For GPs and all other healthcare services, we add up 100% of the Discovery Health Rate

- For generic medicine, we add up 100% of the Discovery Health Medicine Rate. For non-generic medicines, we add up 75% of the Discovery Health Medicine Rate.

We also pay these same amounts from your Above Threshold Benefit.

Over-the-counter medicines do not add up to your Annual Threshold or pay from the Above Threshold Benefit.

No annual limit on some day-to-day healthcare services

We pay for these healthcare services from your Medical Savings Account, with no annual benefit limit. Only the Above Threshold Benefit limit applies:

- GPs

- Specialists

- Pathology

- Radiology

- Basic dentistry

- MRI and CT scans: we pay the first R2 300 of your MRI or CT scan code from your day-to-day benefits. We cover the balance of the scan code from your Hospital Benefit, up to the Discovery Health Rate. For conservative back and neck treatment, specific rules and limits apply.

Limits on some day-to-day healthcare services

We pay all day-to-day benefits up to the limited Above Threshold Benefit or up to the limit that applies below, whichever you reach first. These are not separate benefits; you need to have funds in your Medical Savings Account or have reached your Above Threshold Benefit before we pay up to these limits.

| Classic | Essential | |

|---|---|---|

| Professional services | ||

| Allied and therapeutic healthcare services* (acousticians, biokineticists, chiropractors, counsellors, dieticians, homeopaths, nurses, occupational therapists, physiotherapists, podiatrists, psychologists, psychometrists, social workers, speech and hearing therapists) | Single member: R6 000 With one dependant: R8 500 With two dependants: R11 000 With three or more dependants: R13 000 | Single member: R4 000 With one dependant: R6 000 With two dependants: R7 500 With three or more dependants: R9 000 |

| Antenatal classes | You have R1 000 for your family | |

| Dentistry appliances and orthodontic treatment | R10 850 for each person | |

| Medicine | ||

| Prescribed medicine* (schedule 3 and above) | Single member: R10 950 With one dependant: R13 250 With two dependants: R15 950 With three or more dependants: R17 450 | Single member: R7 800 With one dependant: R9 200 With two dependants: R10 950 With three or more dependants: R13 250 |

| Over-the-counter medicine, including prescribed medicine under schedule 3 and lifestyle-enhancing products | We pay these claims from available funds in your Medical Savings Account | |

| Appliances and equipment | ||

| External medical items | You have R30 250for your family | You have R20 500 for your family |

| Hearing aids | You have R13 500 for your family | You have R9 600 for your family |

| Optical* (includes cover for lenses, frames, contact lenses and surgery or any healthcare service to correct refractive errors of the eye, like excimer laser) | You have R2 800 for each person | |

* If you join the medical scheme after January, you won’t get the full limit because it is calculated by counting the remaining months in the year.

Annual Threshold amounts

| Annual Threshold amount | Overall Above Threshold Benefit limit | |

| Main member | R8 200 | R7 000 |

| Adult | R6 150 | R4 950 |

| For each child (to a maximum of three) | R2 690 | R2 400 |

2012 Monthly contributions

| Classic Priority | Monthly Risk Contribution | Monthly MSA | Total Monthly Contribution | Annual MSA |

|---|---|---|---|---|

| Main member | R1 388 | R462 | R1 850 | R5 544 |

| Adult | R1 093 | R364 | R1 457 | R4 368 |

| Child* | R555 | R185 | R740 | R2 220 |

| Essential Priority | Monthly Risk Contribution | Monthly MSA | Total Monthly Contribution | Annual MSA |

|---|---|---|---|---|

| Main member | R1 352 | R238 | R1 590 | R2 856 |

| Adult | R1 062 | R187 | R1 249 | R2 244 |

| Child* | R540 | R95 | R635 | R1 140 |

* We count a maximum of three children when we work out the monthly contribution.

General exclusions

Discovery Health does not cover certain healthcare services. You can find a full list of these exclusions here.

How to join Discovery Health

We market our Discovery Health Plans through independent and accredited financial advisers. If you want a financial adviser to help you choose a Health Plan to suit the needs of your family, please send us your contact details and we will contact you.